#1 Myths: You Need a Finance Degree to Succeed

#2 Myths: Bank Exams Are Extremely Difficult

#3 Myths: Only Mathematics Experts Can Pass

#4 Myths: You Can't Retake Bank Exams

#5 Myths: The Exam Content Never Changes

As we have discussed common myths about bank exam and bank exams truths now, let us discuss about Common Misconceptions about Bank Exams in brief.

1. Bank Jobs Are Stressful: While there can be pressure in banking jobs, not all roles are highly stressful. The level of stress varies depending on the position and the individual's ability to manage workload and pressure.

2. Bank Exams Are All About Luck: Success in bank exams is primarily based on preparation, knowledge, and skills. While luck may play a small role, it's not a significant factor in determining success.

3. Only Young Candidates Can Succeed: Bank exams often have age limits, but they also provide age relaxations for certain categories. Many candidates succeed in their 30s and even beyond.

4. Bank Jobs Are Unrewarding: Some believe that bank jobs are mundane and do not offer attractive salaries or benefits. In reality, banks offer competitive pay, job security, and opportunities for career growth.

Let us discuss Tips for Success in Bank Exams

- Start by thoroughly understanding the exam pattern, including the number of sections, types of questions, and time allocation for each section. This will help you plan your preparation more effectively.

- Regular practice is a key to success. Solve previous year question papers, take mock tests, and practice sample papers to become familiar with the exam format and improve your time management.

- While speed is important, accuracy is equally crucial. Avoid making unnecessary guesses as negative marking is common in bank exams. Concentrate on answering questions you are confident about.

- Develop a structured study plan that covers the entire syllabus. Allocate specific time slots for each section, focusing on your weaker areas while revising your strengths regularly.

Author : Amrish

Hi, this is Amrish, an Assistant Manager in one of the largest private banks with an extensive background in the banking industry. Having post-graduated with honors in Finance from a renowned university, I embarked on a rewarding career in the financial services industry. With a deep understanding of their unique needs and goals for banking exams, I would love to help aspirants through my blogs. I will keep sharing insights for cracking various exams by providing tips, strategies, mistakes one should avoid, the best resources, and much more. God Speed to all aspirants!

FAQ’s

No, you do not need a finance or economics background to appear for most bank exams. Bank exams typically have educational qualification requirements that specify the minimum level of education needed, such as a bachelor's degree in any discipline from a recognized university.

Coaching classes are not necessary for bank exam preparation, but they can be beneficial for some candidates depending on their individual needs and circumstances.

Some of the common mistakes to avoid during your bank exam preparation are Lack of a structured study plan, ignoring the basics, inconsistent study routine and neglecting mock tests.

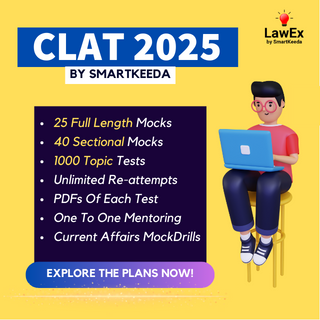

There are several reliable online resources that you can use for bank exam preparation. These resources provide study materials, practice tests, and guidance to help you prepare effectively. Smartkeeda is one stop solution for all your needs which can be access at https://testzone.smartkeeda.com.

Clearing bank exams can open up a wide range of career prospects in the banking sector. Roles like specialist officers, credit analysts, treasury officers, branch manager and regional managers are some of the career prospects which remain always open after clearing bank exams.